TAS Tax Tip: Use caution when paying or receiving payments from friends or family members using cash payment apps - TAS

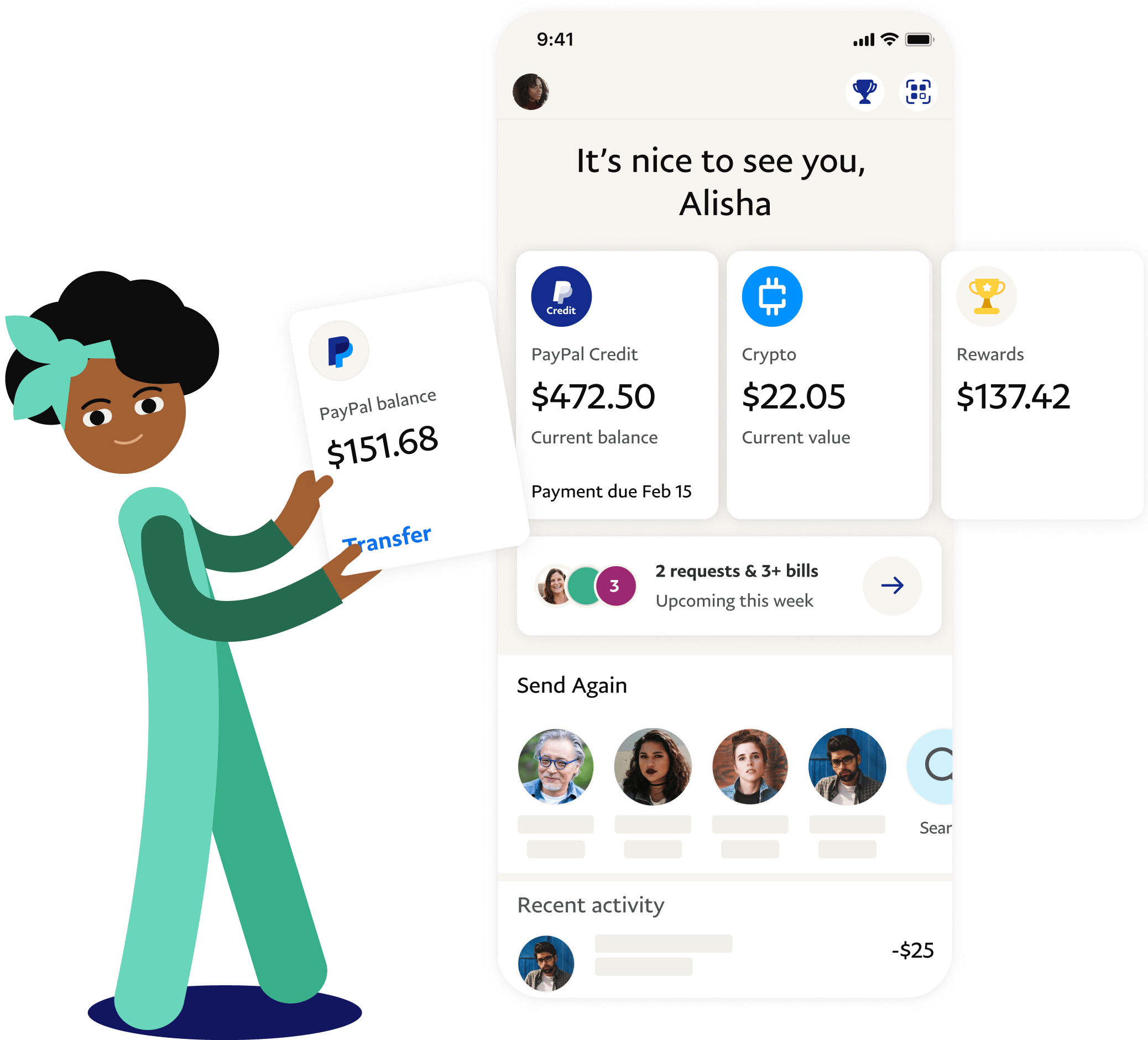

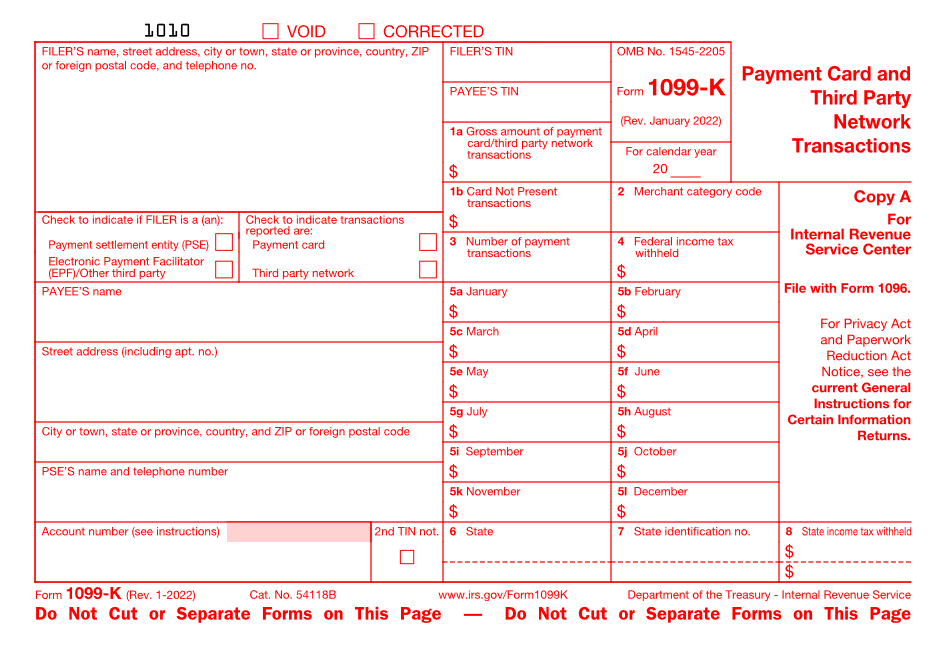

Venmo and Paypal will now share your transactions with the IRS if you make more than $600 a year on the platforms - The Washington Post

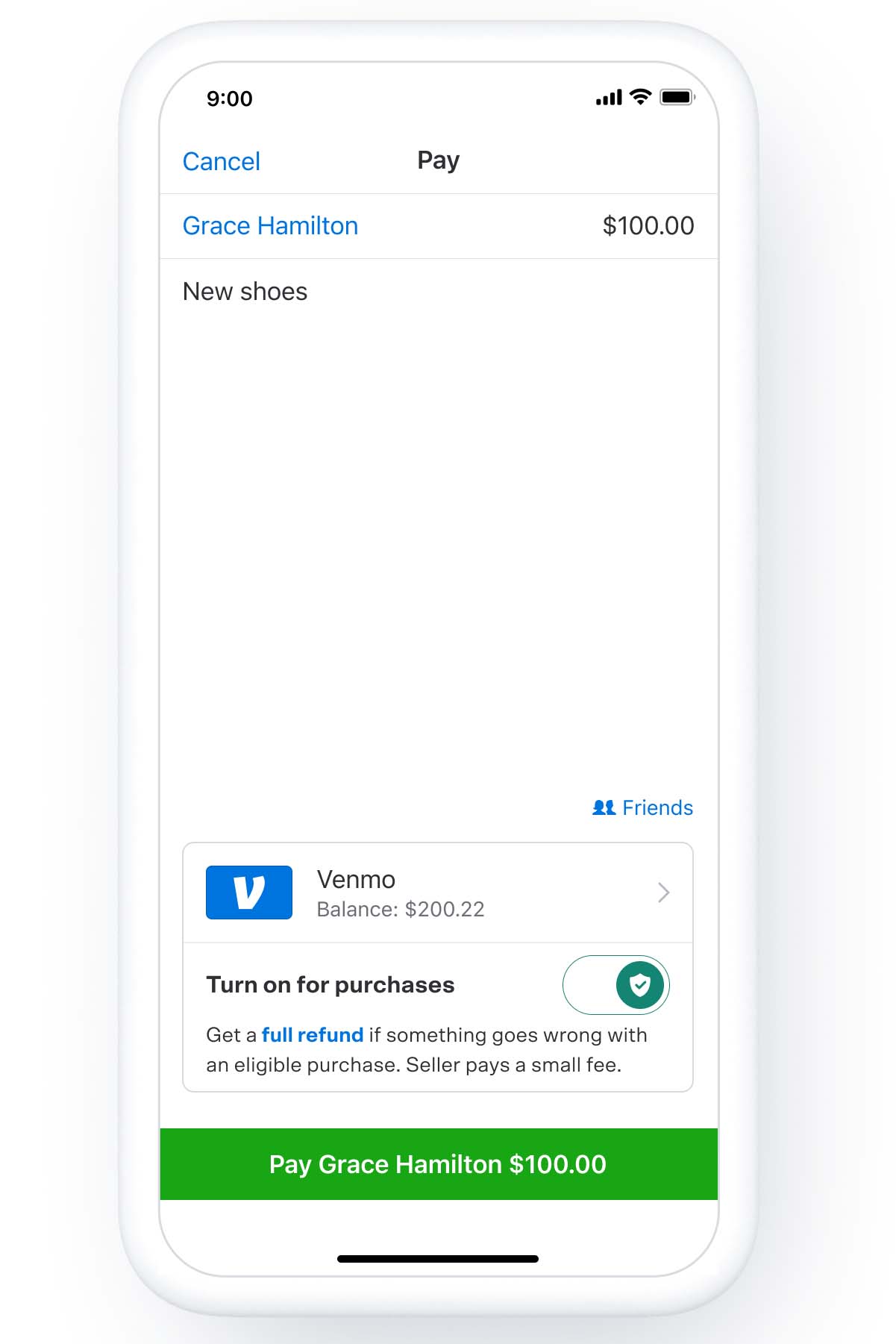

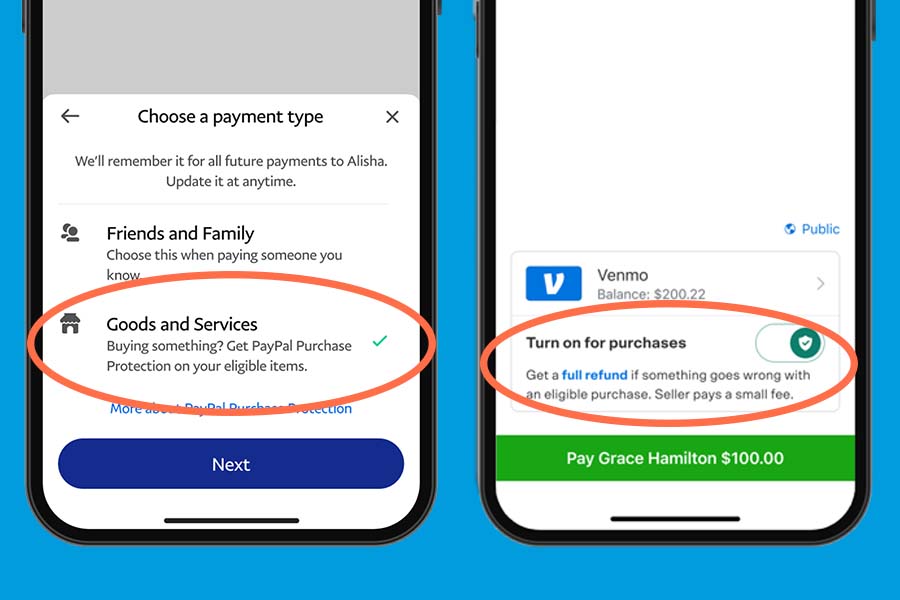

Press Release: How to Confirm Your Tax Information to Accept Goods & Services Payments on Venmo in 2022

New tax laws 2022: Getting paid on Venmo or Cash App? This new tax rule might apply to you - ABC7 New York