Everything Accounting - FACTORING - CASUAL FACTORING - Factoring is a sale of accounts receivable on a without recourse, notification basis. In this kind of financing, the parties involved are the company-seller

![MBA Accounting] Assume the Company measures bad debt expenses as 2% of beginning gross receivables. Calculate the amount of bad debts written off in fiscal year 2021. : r/HomeworkHelp MBA Accounting] Assume the Company measures bad debt expenses as 2% of beginning gross receivables. Calculate the amount of bad debts written off in fiscal year 2021. : r/HomeworkHelp](https://preview.redd.it/mba-accounting-assume-the-company-measures-bad-debt-v0-3x0l82bao0r91.png?width=640&crop=smart&auto=webp&s=4f3d223212e28d2a075083e549eccdf259488684)

MBA Accounting] Assume the Company measures bad debt expenses as 2% of beginning gross receivables. Calculate the amount of bad debts written off in fiscal year 2021. : r/HomeworkHelp

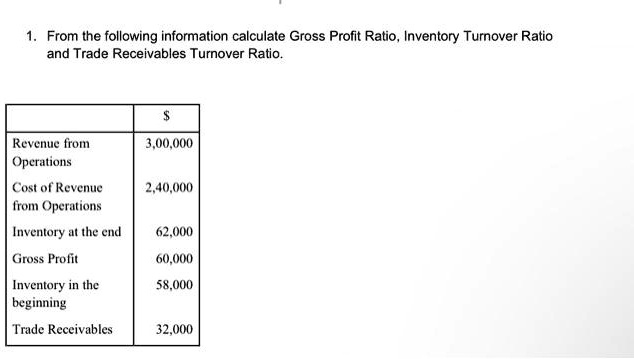

SOLVED: 1. From the following information calculate Gross Profit Ratio,Inventory Turnover Ratia and Trade Receivables Turnover Ratio Revenue from Operations 3,00,000 Cost of Revenue from Operations 2,40,000 Inventory at the end 62,000

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)